Healthcare bills can pile up quickly these days. If you're participating in a physical therapy program, you're probably looking for easy ways to reduce costs.

My patients often forget they can use their Health Savings Account (HSA) for physical therapy, which would otherwise save them money. Let's go over what an HSA is in more detail and learn how to use an HSA for physical therapy treatments.

Key Takeaways

- An HSA allows you to save pre-taxed money for healthcare expenses like physical therapy.

- Funds from your HSA can be used anytime for physical therapy, and they roll over to the next year.

- In 2024, the limit for self-only HSA contributions is $4,150. The limit for families is $8,300.

Table of Contents

- What is a Health Savings Account (HSA)?

- Using HSA Funds for Physical Therapy in 2024

- Understanding Flexible Spending Accounts (FSAs)

- Comparing HSAs and FSAs for Physical Therapy

- How to Maximize Your HSA for Physical Therapy

What is a Health Savings Account (HSA)?

A health savings account, or HSA, is a savings account that helps you pay for certain healthcare costs. With this savings account, you can save pre-taxed money for health care costs throughout the year.

This way, you won't have to pay taxes on the income you use for qualified healthcare costs, saving you money in the long run.

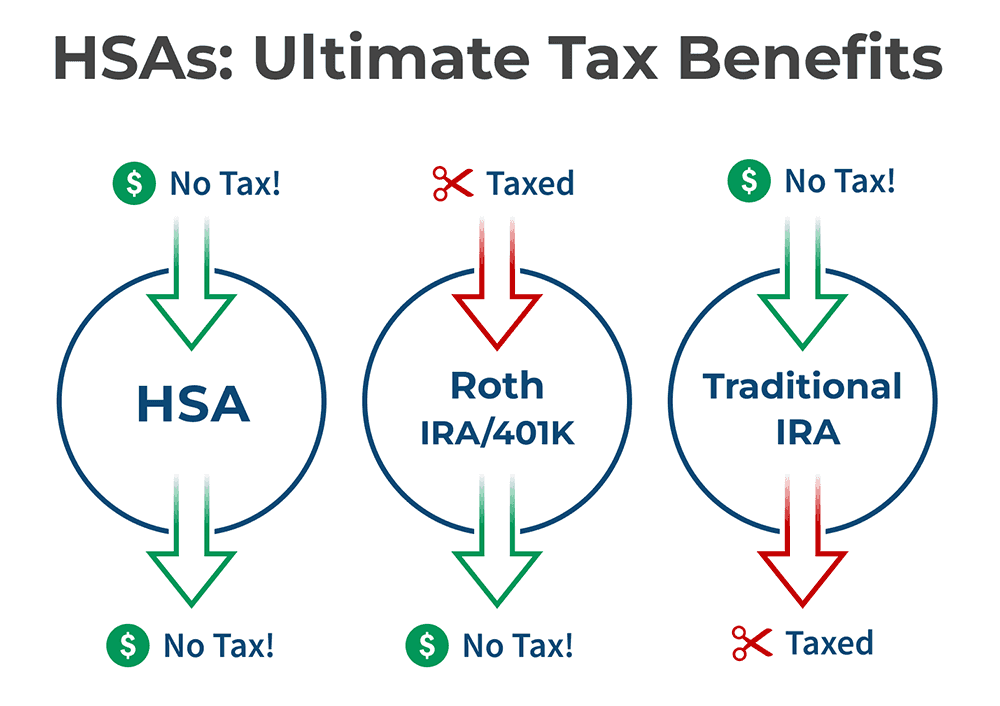

Among all the popular options for growing wealth in a tax-advantaged way—401(k) accounts, traditional and Roth IRAs, and HSAs—HSAs are the most powerful due to their triple tax advantages: contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified medical expenses are tax-free.

To contribute to an HSA, you must be enrolled in an HSA-eligible health insurance plan from your HSA provider, often known as a high-deductible Health Plan (HDHP). However, you can use the money in an HSA to pay for medical expenses anytime. In 2024, the limit for self-only contributions is $4,150 or $8,300 for family coverage.

HSA funds can be used to pay for qualified medical expenses, vision costs, dental expenses, and more. You typically get your HSA funds on a debit card, or you use your own money and then submit for reimbursement to your insurance company.

Using HSA Funds for Physical Therapy in 2024

With an HSA, your funds can be withdrawn tax-free when you use them for any qualified medical expense, including physical therapy. Physical therapy services fall under the category of "treating structures and functions of the body," which is considered a medical expense.

Most physical therapy services used to treat a documented medical condition will qualify.

For example, you can get reimbursement for evaluations, therapy sessions, and many medical supplies.

Let's say that your health insurance plan will only cover six sessions of physical therapy after you've had surgery. You can use your HSA to pay for any additional sessions that you need.

Or your therapist might recommend a special piece of equipment to use at home as part of your therapy plan. You could potentially use your HSA to pay for the cost of the equipment.

Tip from the clinic: When you begin your physical therapy treatments, you should request a special invoice known as a "superbill" which will include the necessary information you'll need to prove to your insurance company the money was spent on qualified medical services.

Understanding Flexible Spending Accounts (FSAs)

A Flexible Spending Account (FSA) can also be used to pay for qualified medical expenses like physical therapy. An FSA is a savings account for medical services that your employer offers. With an FSA, you set aside a certain amount every year into the account, which is taken from your paychecks.

One key difference between a flexible spending account (FSA) and an HSA is that an FSA doesn't require a high-deductible health care plan to qualify.

Another potential perk of using flexible spending accounts is that your employer can contribute to it, like other health reimbursement accounts.

The drawbacks to flexible spending accounts include use-it-or-lose-it policies, which means that the money must be spent in that year because it won't roll over to the next. Although some companies do offer a grace period where you can still access your funds for a couple of months, not all employers do.

There's also a limit to what you can contribute to your FSA funds. In 2024, the limit you can contribute is $3,200. You won't be able to change your contribution during the year, and if you leave your employer, you may lose the funds.

If your physical therapy costs are predictable, having an FSA may be a good idea, as you know what the costs are going to be each year.

Comparing HSAs and FSAs for Physical Therapy

Both HSAs and FSAa are great options for saving money on medical expenses using pre-taxed income.

When deciding whether to use an HSA or an FSA account to pay for physical therapy, you should consider a couple of things.

First, try to project your physical therapy costs for the year and make sure that these expenses qualify.

An HSA has the advantage when you'll be needing physical therapy on an ongoing basis during the year, since you can lower your taxable income and the money you save rolls over from one year to the next.

An FSA has the advantage if will need physical therapy for just short period of time, or if you find yourself towards the end of the year with unspent funds — better use it or lose it.

In one year, you can use both an HSA and an FSA to help you pay for physical therapy costs, but you can't use them both on the same claim.

How to Maximize Your HSA for Physical Therapy

Here are some tips for how to maximize your health savings account for physical therapy costs:

- Try to predict your physical therapy expenses at the beginning of the year and make sure that your HSA will have the funds in the account when you need them.

- When you combine your HSA for physical therapy funds with your current insurance plan, you can use the HSA funds until you reach your deductible and help pay for out-of-pocket costs.

- Use your HSA for ongoing sessions, and the flexible spending accounts for more episodic physical therapy sessions.

- Make sure to save detailed records of physician letters, PT bills, and prescription records for reimbursement of the relative cost of your services and treatment.

Conclusion

If you are ready to use your HSA or FSA for physical therapy, reach out to CityPT today. Our expert team of therapists can help you determine if your HSA will qualify for any of our recovery or wellness programs.

Before you go, please read our disclaimer. This blog is intended for informational purposes only. We are not providing legal or medical advice and this blog does not create a provider-patient relationship. Do not rely on our blog (or any blog) for medical information. Always seek the help of a qualified medical professional who has assessed you and understands your condition.

Dr. Anand completed her Orthopaedic Physical Therapy residency at the Johns Hopkins Medicine and the George Washington University after earning her Doctor of Physical Therapy degree in 2021 from the George Washington University. She practices in the Austin, TX area.

Dr. Anand completed her Orthopaedic Physical Therapy residency at the Johns Hopkins Medicine and the George Washington University after earning her Doctor of Physical Therapy degree in 2021 from the George Washington University. She practices in the Austin, TX area.